A Trusted Steward

We do things today with tomorrow clearly in our mind, aiming to do right, do well, and do good, for our present and future generations.

Our Temasek Charter defines who we are and what we do as an investor, institution and steward.

We are governed by the Singapore Companies Act and the Singapore Constitution.

Temasek has a constitutional

responsibility to safeguard its

own past reserves.

Temasek is an exempt private company under the Singapore Companies Act. Our Board has a fiduciary duty towards Temasek as a Company, with the full discretion and flexibility to guide the management of our portfolio as an active investor and owner, a forward looking institution and a trusted steward.

Under the Singapore Constitution, Temasek is a Fifth Schedule entity with a constitutional responsibility to safeguard our Company’s past reserves.

Temasek does not manage Singapore’s Central Provident Fund savings, or the budget surpluses or foreign exchange reserves of Singapore. Nor does Temasek manage the reserves of any other Fifth Schedule entity: these are independently managed by the relevant Fifth Schedule entities themselves.

Temasek does not manage

Singapore’s Central Provident Fund

savings.

Temasek’s past reserves are those accumulated by the Company before the current term of Government.

Temasek does not manage

Singapore’s Central Provident Fund

savings.

Neither the President of Singapore nor the Singapore Government is involved in our investment or other business decisions, except in relation to the protection of our past reserves.

Our annual statutory financial statements are audited by a major international audit firm.

Relating to the President of Singapore

We have a duty to ensure

every disposal of investment

is transacted at fair market value.

The Board and CEO of Temasek have the responsibility under the Singapore Constitution to protect our Company’s past reserves.

The Board and CEO of Temasek have a duty to seek the President’s approval before any draw occurs on our past reserves. There is no draw on our past reserves if our total reserves equal or exceed our past reserves. Mark to market declines on existing investments are not a draw on past reserves. We have a duty to ensure every disposal of investment is transacted at fair market value. A realised loss arising from such disposals at fair market value is not a draw on past reserves.

We have a duty to ensure

every disposal of investment

is transacted at fair market value.

Under the Singapore Constitution, Temasek’s past reserves are those Temasek accumulated before the current term of Government. Temasek’s current reserves are those Temasek accumulates during the current term of Government.

On the eve of the first day of each term of Government, Temasek’s total reserves — comprising our past reserves and current reserves at the changeover — are locked up as past reserves. This cycle repeats every time there is the swearing in of a new Government after a General Election.

Relating to Our Shareholder

Incorporated on 25 June 1974, Temasek is wholly owned by the Singapore Minister for Finance. As a commercial investment company, we are the owner of our assets — we are not a fund manager on behalf of our shareholder.

Our shareholder’s right under the Singapore Companies Act to appoint, reappoint or remove our Board members is subject to the President’s concurrence. The Board’s appointment or removal of the CEO is also subject to the President’s concurrence. These constraints are part of the “second key” concept, to safeguard the integrity of our Board and CEO in protecting Temasek’s past reserves.

We are the owner of our assets,

not a fund manager on behalf of

our shareholder.

Temasek declares dividends annually in accordance with our dividend policy. Our Board ensures that our dividend policy balances the sustainable distribution of profits as dividends to our shareholder with the retention of profits for reinvestment to generate future returns. The policy also takes into account our constitutional responsibility to protect Temasek’s past reserves. Our Board recommends the dividends for our shareholder’s acceptance at the annual general meeting.

Under the Net Investment Returns (NIR) framework, the Government is permitted to spend up to 50% of the expected long term real rates of return of GIC, the Monetary Authority of Singapore and Temasek. The NIR framework does not affect, change or impact Temasek’s dividend policy, strategies and operations as a long term investor, and our responsibility to protect Temasek’s past reserves.

Relating to Our Portfolio Companies

We manage our portfolio as an active investor and asset owner. We increase, decrease or hold our investment positions based on our views on intrinsic values, to enhance our risk-adjusted returns for the long term.

We expect companies to abide by

sound corporate governance and

codes of conduct and ethics.

We advocate that boards

be independent of management

in order to provide effective oversight

and supervision of management.

The day-to-day management and business decisions of companies in our portfolio are the responsibility of their respective boards and management. Temasek does not direct their business decisions or operations. Just as the Singapore Government does not issue financial guarantees for our obligations, we do not issue financial guarantees for the obligations of our portfolio companies.

We expect companies to abide by

sound corporate governance and

codes of conduct and ethics.

We hold the boards and management accountable for the activities of their companies. We expect companies to abide by sound corporate governance and codes of conduct and ethics. Boards should set the tone — to effectively oversee management and ensure robust governance and compliance systems and processes are in place. These must be constantly reviewed and refreshed to ensure relevance.

We advocate that boards

be independent of management

in order to provide effective oversight

and supervision of management.

We support the formation of high calibre, experienced and diverse boards to guide and complement management leadership. This includes encouraging the boards of portfolio companies to identify and consider potential directors with relevant backgrounds and experience, and to conduct annual reviews of their succession plans.

Board directors have a fiduciary duty to safeguard the interests of their respective companies.

Temasek does not direct

the business decisions or

operations of our portfolio companies.

Accordingly, we advocate that boards be independent of management in order to provide effective oversight and supervision of management. This includes having mostly non-executive board members with the independence and experience to oversee management.

Temasek does not direct

the business decisions or

operations of our portfolio companies.

We advocate that the Chairman and CEO roles be held by separate persons, independent of each other.

This is to ensure a healthy balance of power for independent decision-making, and a greater capacity for management supervision by the board.

We regularly monitor the strategy and performance of our portfolio companies and keep abreast of industry developments that impact them. This informs how we exchange and share perspectives with the boards and management of our portfolio companies, so as to better understand their strategies and operating environments.

We hold the boards and management accountable for the activities of their companies.

We protect our interests by exercising our shareholder rights, including voting at shareholders’ meetings.

We comply with our obligations under Singapore laws and regulations, as well as those of the jurisdictions where we have investments or operations.

Likewise, we expect our portfolio companies to comply with their obligations under the laws and regulations of jurisdictions in which they have investments or operations.

Relating to Our Communities

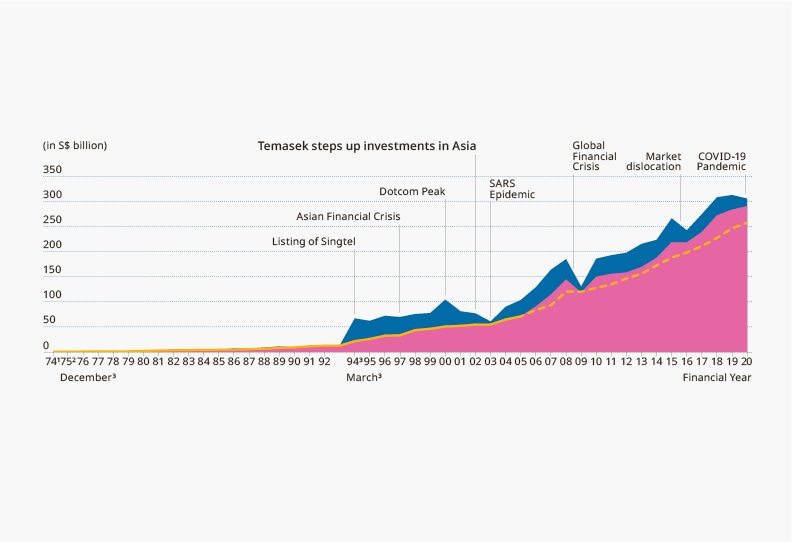

As a Singapore exempt private company, Temasek is exempted from disclosing its financial information publicly. We have nonetheless published our Group Financial Summary and portfolio performance in our annual Temasek Review since 2004.

We gift endowments for our communities based on the twin pillars of sustainability and good governance. These are funded by a share of our net positive returns above our risk-adjusted cost of capital.

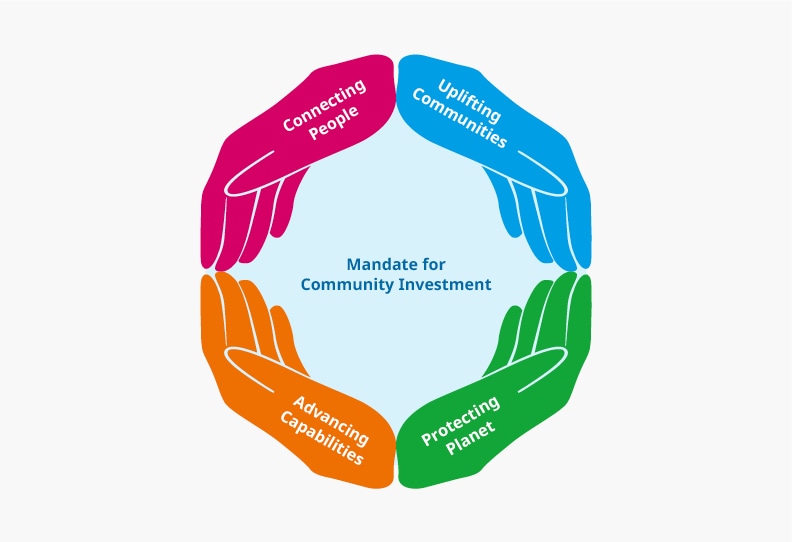

These philanthropic endowments focus on connecting people, uplifting communities, protecting our planet and advancing capabilities. Their outcome-focused programmes enable individuals, families and communities to achieve sustainable improvements and progress in their lives.

We gift endowments for communities

based on the twin pillars of sustainability

and good governance.

We support the enhancement of social policies through evidence-based results from pilot programmes, and sustainable long term solutions. We aim to strengthen social resilience at home, foster mutual exchanges in the region and advance science and nature globally.

We gift endowments for communities

based on the twin pillars of sustainability

and good governance.

The skills required for the financial management of endowment funds are very different from those for developing and delivering community and social programmes. This was why we established Temasek Trust in 2007 - to oversee the financial management and distribution of endowments and gifts from Temasek, which have been earmarked for the non-profit philanthropic Temasek Foundation.

Our endowments focus on

connecting people, uplifting communities,

protecting our planet and

advancing capabilities.

This governance model separates the financial management of endowments from the programme design and delivery of the Foundation. This enables the Foundation to focus on developing programmes for the community, with the reassurance that its endowment funding is professionally managed to provide its beneficiaries with a sustainable source of support over the years.

Our endowments focus on

connecting people, uplifting communities,

protecting our planet and

advancing capabilities.

Alongside the work of the Foundation, our staff volunteers play an active role in contributing to their communities. Through our staff-driven volunteer T-Touch initiative, our employees commit ideas, time and money to support their chosen charities and community projects, and pursue philanthropic and public good causes.

We follow developments in international investment and trade agreements, and engage with thought leaders and authorities. We also aim to promote a better understanding of how we operate based on commercial principles, independent of government interference. An example is our active participation in support of the International Monetary Fund, to develop best practices for responsible investing for investors and host countries, under the Santiago Principles for sovereign investments.

Temasek exceeds the applicable standards of disclosure and other guidelines under the Santiago Principles.

From time to time, we may seed institutions to develop capabilities that promote good governance and community stewardship. In addition, we collaborate with like-minded partners, such as universities and multilateral agencies, to build these institutions.