Investing in Bonds

What are my risks if I invest in bonds?

When you invest in a bond, you are essentially lending money to a bond issuer.

One key risk is the issuer defaulting on its payments or repayment to you. Market, business, legal and regulatory risks may affect the issuer’s ability to pay you the bond interest, or to repay the principal amount, for as long as you own the bond.

Other risks such as interest rate and market liquidity risks may affect your ability to sell in the market if you choose to sell the bond before maturity.

You should also be mindful of other risks such as inflation.

Default Risks

A default occurs when a bond issuer fails to pay you the interest due, or repay the principal amount of your bond at maturity.

Different issuers have different default risks, depending on their financial health, debts and other obligations.

Various credit rating agencies use their own quantitative and qualitative criteria for rating issuers or their bonds. Past data on the default rates for different levels of credit rating are also useful reference points.

Be mindful that defaults have historically happened even for the highest credit quality bonds, and that the past does not predict the future.

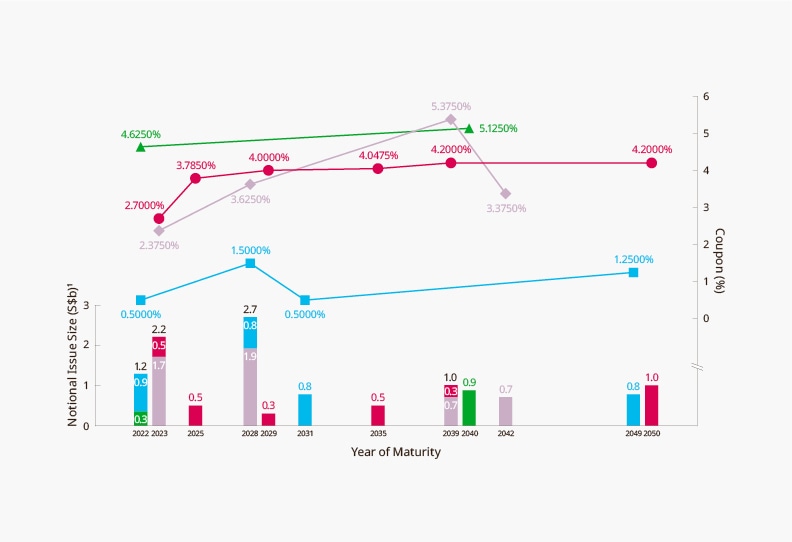

Average Annual Corporate Default Rates: 2000 - 2019 (%)

It is very important for you to know more about the credit quality of an issuer before buying its bond.

In the case of Temasek Bonds, if the issuer does not have enough cash to pay interest due or repay its principal amount due at maturity, Temasek Holdings (Private) Limited will step in as the Guarantor.

If the Guarantor becomes insolvent, holders of Temasek Bonds and other equally ranked creditors will rank ahead of the Guarantor’s shareholder in terms of payment priority.

Market & Business Risks

Macroeconomic, market and geopolitical conditions in major economies may impact global monetary conditions, investors’ confidence and risk appetite, as well as underlying growth prospects and global asset prices.

As an investment company, the value of Temasek’s portfolio is affected by such market factors.

Furthermore, Temasek’s cash flows and ability to make debt repayments are dependent on the dividends and distributions from our portfolio, our divestments and our ability to borrow. In particular, dividends and distributions are made by our portfolio companies at their discretion and are subject to their profitability and cash flows, among other considerations.

Should any of our portfolio companies run into financial difficulties, our claim as a shareholder would generally rank behind creditors of such a company.

Legal & Regulatory Risks

Companies and businesses operating around the world must comply with a complex set of different legal and regulatory requirements, which may change or evolve in ways that may have an impact on their existing business. They may face regulatory or litigation action by regulators or other parties.

Temasek and our portfolio companies are subject to similar risks. These may result in significant costs or losses to Temasek or our portfolio companies and could impact Temasek’s ability to meet payment obligations.

Interest Rate Risk

The market price of a bond may rise or fall.

If interest rates rise, the market price of your bond may fall, in order to attract buyers who may have higher interest alternatives.

If the market price at the time you sell your bond is below your purchase price, you may suffer a partial loss of your principal amount.

There is no guarantee on the market price of Temasek Bonds.

Liquidity Risk

Under certain situations, such as a difficult market, there may be no buyer for your bonds should you need to sell them, even when they are listed.

There is no guarantee on the market liquidity of Temasek Bonds.

Inflation Risk

Inflation will lower the purchasing power of the fixed interest payments and the principal amount at maturity of any bond.