Financial Discipline

We are governed by a set of stringent financial policies and disciplines.

We manage our leverage, liquidity, and balance sheet prudently for resilience and flexibility, even in times of extreme stress. We ensure that our primary sources of cash flows can cover our non-discretionary expenses, such as operating expenses, interest to bondholders, and debt repayments.

Our Board sets our overall debt limit, taking into account our shareholder funds, cash flow and credit profile.

Capital and Liquidity Management

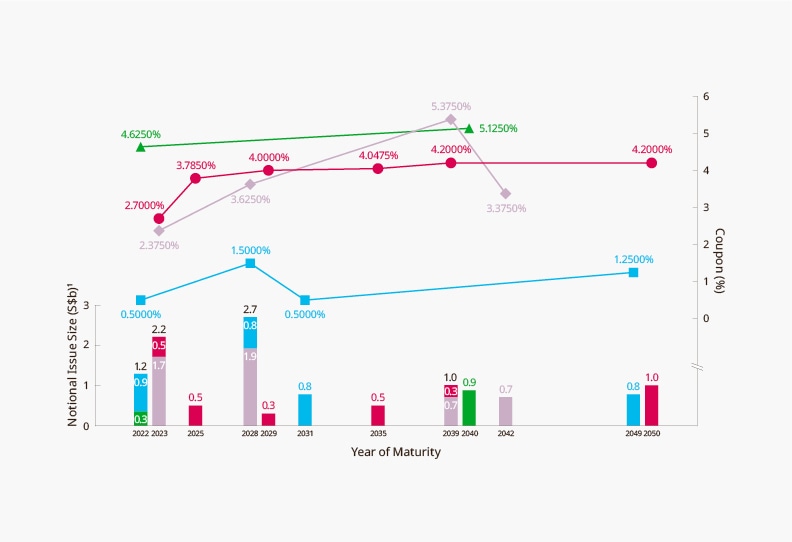

Our primary sources of funds include divestment proceeds, as well as dividends and distributions received from our portfolio. These are supplemented by our Temasek Bonds and Euro-commercial Paper.

We plan proactively for a long dated and well distributed debt maturity profile, and avoid a large debt tower in any one year.

Liability Management

Temasek does not issue any financial guarantees for the obligations of our portfolio companies.

Foreign Exchange Management

Our projected risk-adjusted return for each investment proposal needs to also cover foreign exchange (FX) risk. Where appropriate, we close up our FX exposure using the relevant FX instruments.

(for year ended 31 March)

Key Recurring Income vs Debt Maturity Profile (S$b)

- Dividend income

- Divestments

- Debt due up to 1 year

- Debt due 1 to 3 years

- Debt due 3 to 10 years

- Debt due after 10 years